tax minimisation strategies for high income earners

If you want to pass on money during your lifetime to loved. If you would like a second.

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

In this post were breaking down five tax-savings strategies that can help you keep more money in your pocket.

. One of the most popular tax-saving strategies for high-income earners involves charitable contributions. Max Out Your Retirement Account. Because his income is so high any extra income will be taxed at the highest rate currently at 465.

If theres potential for a high return by. So the money was distributed to Mary. Take advantage of vehicles for future tax-free income.

Bonds mature with an initial return for the buyer. This is a tax-effective strategy because super contributions are taxed at the. This is an important strategy for residents of high-income tax states with significant investment income.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. 5 Tax Minimization Strategies for High-Income Earners and Small Business Owners 1. Trusts can also help reduce your state income tax liability on investment earnings so while the Federal tax rate stays the same there are savings on state taxes.

This is a tax-effective strategy because super contributions are taxed at the concessional rate of 15 in Australia. Another tax planning strategy for. Gifting limits and exclusions.

Business owners hire your kids. 401k or 403b. Donate More to Charity.

In 2021 the employee pre-tax contribution limit for. They borrow cash in exchange for fixed payments. 50 Best Ways to Reduce Taxes for High Income Earners 1.

According to the ATO youre classified as a higher income earner if you earn over 180000 a year. Max Out Your Retirement Contributions. This is an important strategy.

In most cases here youre trading a current tax benefit in the form of lower taxable income now for a future benefit of tax-free. Because she stays at home she. Lets start with retirement accounts.

One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account. In fact if youre earning in excess of 180000 youre taxed at 47 for the privilege. The Roth 401k sub-account and the Mega Backdoor Roth are both tax saving strategies for high income earners who want a future tax-free income.

Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. 9 Ways for High Earners to Reduce Taxable Income 2022 1. Re-examine Standard or Itemized Deductions.

If you are an. High-income earners should consider investing in municipal bonds. Salary sacrificing into super involves forgoing some of your pre-tax salarywages and putting it into super instead.

At Imagine Accounting we work with a number of high income earners to help them legally minimise their tax bill and make the most of their income. This rate is lower than the personal income tax rate. Under RS rules you can deduct charitable.

What Are Marriage Penalties And Bonuses Tax Policy Center

18 Ways To Reduce Your Taxes The Motley Fool

The Relationship Between Taxation And U S Economic Growth Equitable Growth

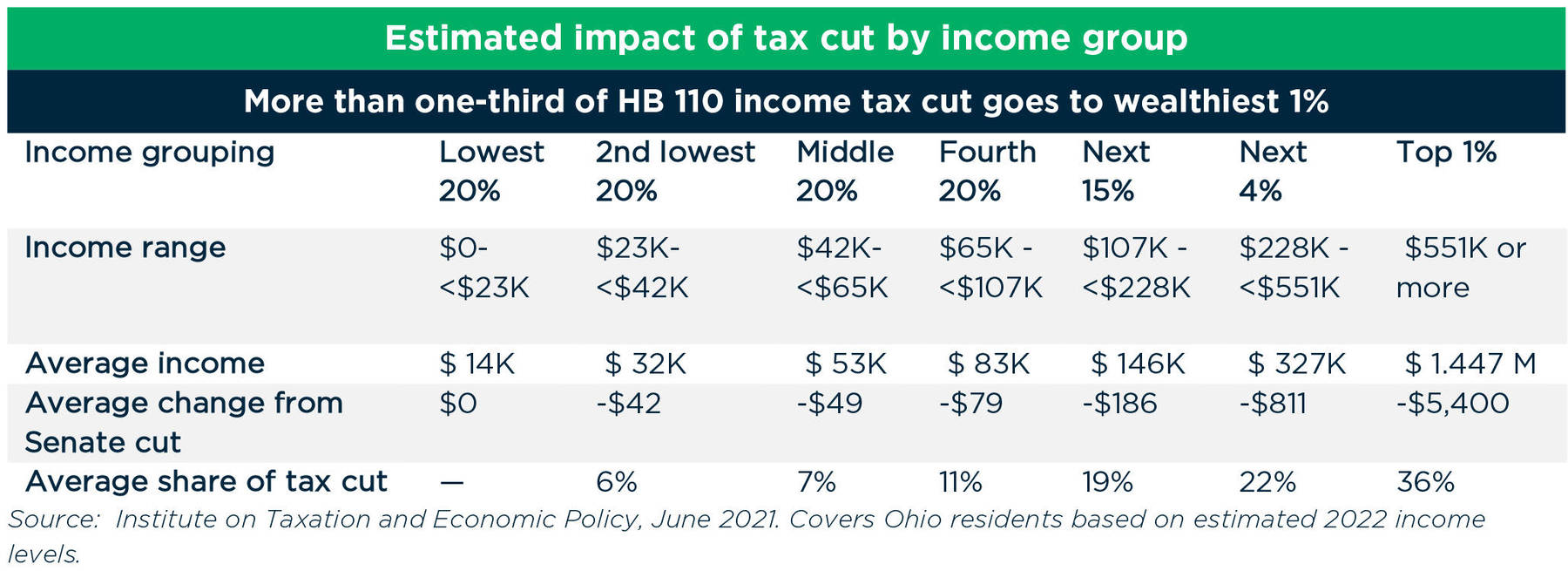

Ohio Tax Cuts Would Go Mostly To The Very Affluent

What Do Your Property Taxes Pay For Property Tax Consumer Math Family And Consumer Science

Tax Strategies For High Income Earners 2022 Youtube

9 Ways For High Earners To Reduce Taxable Income 2022

The 4 Tax Strategies For High Income Earners You Should Bookmark

The Hierarchy Of Tax Preferenced Savings Vehicles

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

10 Creative But Legal Tax Deductions Howstuffworks

Entrepreneurs Here S How To Pay Less Taxes

3 Tax Strategies For High Income Earners Pillarwm

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Strategies For High Income Earners Wiser Wealth Management

9 Ways For High Earners To Reduce Taxable Income 2022

8 Ways To Pay Less In Taxes And Save Money Business Tax Tax Reduction Tax Deductions

5 Outstanding Tax Strategies For High Income Earners

How High Income Earners Can Reduce Taxes Through Tax Planning Financial Planning